On 31 March, 2017, CPC partially repaid its debt to the Shareholders. Principal and interest repayment amounted to USD 210 mln.

It should be noted that in its financial operations CPC is guided by the cash waterfall principle determined by CPC Shareholders.

Current priority is repayment of the Shareholder debt under the Loan Agreements between CPC-R, CPC-K as borrowers and the Government and Producer Company Shareholders as lenders in 1997. The amount repaid in 2015 was USD 1.5 bln. and in 2016 – USD 1.27 bln. Amount outstanding as of the beginning of 2017 is approximately USD 4.49 bln.

It is envisaged that such rate of debt repayment will enable CPC to repay the Shareholder debt in full by 2020 and to commence paying dividends.

FYI:

The CPC pipeline system is one of the largest investment projects with foreign capital in the energy sector in the CIS. The length of the pipeline connecting oil fields in Western Kazakhstan with Marine Terminal in Novorossiysk is 1,511 km. CPC’s Marine Terminal is equipped with Single Point Moorings that allow to load tankers safely at a significant distance offshore, including bad weather conditions.

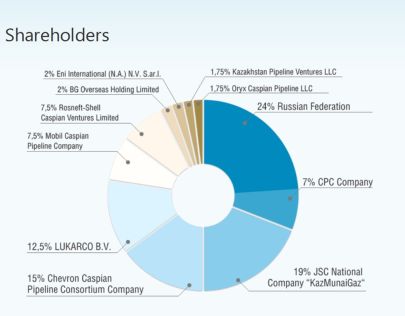

CPC Shareholders: Russian Federation (represented by Transneft – 24% and CPC Company – 7%) – 31%; Republic of Kazakhstan (represented by Kazmunaygaz – 19% and Kazakhstan Pipeline Ventures LLC – 1.75%) – 20.75%; Chevron Caspian Pipeline Consortium Company - 15%, LUKARCO B.V. - 12.5%, Mobil Caspian Pipeline Company – 7.5%, Rosneft-Shell Caspian Ventures Limited – 7.5%, BG Overseas Holding Limited - 2%, Eni International N.A. N.V. - 2% and Oryx Caspian Pipeline LLC – 1.75%.